Indian paper industry growing at 7%: IPMA

According to a report released by Indian Paper Manufacturers Association (IPMA) detailing the paper industry overview for 2017-2018, the per capita paper consumption in India is currently around 13-kgs, while the global average is 57-kgs. This is projected to increase to at least 17-kgs by 2024-25.

24 Dec 2019 | By Rahul Kumar

India’s share in world production of paper is about 3.7%, with estimated production of over 15-million tpa.

The report said the paper industry has the market size of more than 17-million tonnes of paper and growing at around 7% per annum.

Meanwhile, the annual turnover of the paper industry is estimated to be Rs 60,000-crore, with around INR 4,500-crore contribution to the exchequer. The industry provides direct employment to 0.5-million persons, and indirectly to around 1.5-million.

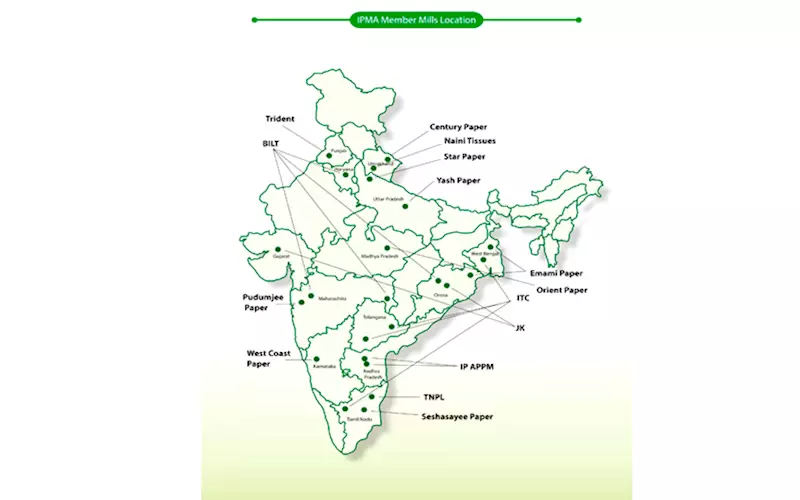

Again, with the period under consideration, the top 15 paper manufacturers who are IPMA members, produced 3,828,415-tonnes of paper, out of total production 3,368,994-tonnes sold in domestic market. The export figure was 448,980-tonnes.

According to the report, the reasons for growth of paper industry in country are continuous demand for education and literacy, increasing organised retail, growth in eCommerce, FMCG, pharma/ healthcare sector, demand of quality packaging, ban on plastic (especially polythene bags) and increment in demand of eco-friendly paper bags, continuously increasing demand of ready-to-eat food and printed stationary.

Among them, newsprint has 2.585-million tonnes of market share and growing at 2.06%; writing and printing paper (uncoated + coated) has 5.065-million tonnes of market share and growing at 4.86% per annum; packaging paper/ paperboard (kraft paper/ paperboard and duplex paperboard) has 8.710-million tonnes market share and growing at 8.37%; tissue paper has 0.165-million tonnes and growing at 17.75%; mg variety/ poster has 0.239-million tonnes of market share and growing at 2% and other paper/ paperboard has 0.355-million tonnes market share and growing at 10.75% per annum.

Under the baseline scenario, by 2024-25, domestic consumption is projected to rise to 23.5-million tpa and production to 22.0-million tpa. About one million tpa of integrated pulp, paper and paperboard capacity is required to be created in India on an annual basis over the current capacity to meet the growing demand.

Such investments would create a multiplier effect on the economy through gross capital formation of Rs 8,500-crore every year, direct employment to 15,000 people every year and further giving additional livelihoods of 72-million man days per year (for people involved in agro/ farm forestry).

If the investments are not made, the growing demand will be met through imports, which will result in a substantial foreign exchange outflow. The compounding effects of this over a 10-year period are truly staggering.

While the industry has already made significant capital investments to ramp-up capacities, the gestation period is long and the economic viability of the investments has been impacted significantly by raw material shortage and rising imports.

Rohit Pandit, general secretary, IPMA, said, “India’s Pulp & Paper Industry has taken rapid strides in recent years to raise its production levels and quality standards to meet the growing demand for paper and paperboard in the country. It is slowly but surely also working towards establishing a global footprint by building a strong export portfolio. We are convinced that the pulp & paper industry has the resilience to face the challenges and work towards gaining a competitive edge on a sustained basis by conserving resources and reducing costs, while improving efficiency and quality levels.”

See All

See All