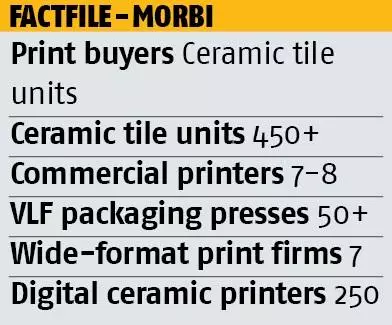

The Rs 7,000-cr ceramic industry has boosted print in Morbi. Today, the city has the highest density of digital printers for ceramic printing in the world with 250 machines. WORDS: Noel D’cunha and Rushikesh Aravkar.

Morbi, a bustling city in the state of Gujarat, is the ceramic capital of India with more than 450 ceramic tile manufacturing plants each producing about 5,000 tile packs per day.

Each of the 450 ceramic tile manufacturing plants produces 5,000 tile packs per day

With Rs 7,000 to 8,000 crore turnover, the ceramic industry in Morbi traces its origin to 1932, when the king of Morbi, Maharaja Lakdhir Singhji, brought in the technology to produce earthenware with an intention to generate employment. The pottery plant was named: Parshuram Pottery Works after Parshuram Ganphule from the erstwhile Baroda (now Vadodara). The king appointed Ganphule to manage the pottery plant.

Since then several pottery plants mushroomed in Morbi and nearby areas. And with technological developments coming in, the pottery and roofing tile industry in Morbi has evolved to what it is today, the third largest ceramic tile producers of the world, after China and Brazil.

Ceramic industry – the print buyer

When we spoke to Raju Patel, director of the Rs 200-crore Face Ceramics in Morbi, we realised that the ceramic industry of Morbi is the major driver of the printing and packaging industry in the city.

Patel says, “We spend a little over 1% of our turnover on printing and packaging requirements which adds up to Rs 25 lakh per month.”

This makes the entire printing and packaging market of Morbi worth 70-crore to Rs 80-crore. Printing material primarily comprises of catalogues and brochures, books in the commercial segment and litho-laminated corrugated cartons in the packaging segment.

Interestingly, there are seven-eight commercial print firms in Morbi with two major players – Print Zone Offset and Morbi Print City, turning over Rs 10 crore business, while the rest put together cover another Rs 10 crore. These two commercial printers cater to 80% of the commercial printing requirements of Morbi.

Print Zone Offset’s facility has recently commissioned a refurbished five-colour Heidelberg CD 74 with extended IR drier by replacing the Heidelberg MOV press. The print facility comprises of raft of post-press equipment which include perfect binders, stitchers, APL’s screen printing machine, lamination machine etc.

“Catalogues play a vital role in marketing of ceramic products hence the print quality has to be good so as to attract the end-customers,” says Jasmin Patel, director, Print Zone Offset. Jasmin is a designer by profession and looks after the photography and designing aspects of catalogue. He is partnered by Naresh Agora in managing Print Zone’s print business.

Jasmin adds, “It takes 45 days for us to accomplish one catalogue job. The process comprises – shooting high quality photographs, processing, designing and then printing.” All the photography, designing and printing of brochures is done inhouse except for CTP, which is sourced from Rajkot.

The other prominent print firm in Morbi is Morbi Print City, smaller of the two with a turnover of Rs 4-crore. Morbi Print City’s infrastructure consists of a four-colour Dominant press, and a few post-press equipment like lamination and binding machines.

Vimal Patel of Morbi Print City with the Newtech’s Nova jet wide-format digital printer

Morbi Print City is managed by two partners, Narendra Patel and Vimal Patel. The firm’s immediate plans include replacing the existing four-colour Dominent with a new Komori Enthrone press. “We are in the process of finalising the deal and hope to have the machine commissioned in a couple of months,” says Narendra.

Besides offset printing, Morbi Print City also offers wide-format solutions and houses a Newtech’s Novajet wide-format digital printer. “The OOH requirement of the city is 50,000 sq/ft of which we print 10,000 sq/ft per month. The shelf life of every OOH is about six months.”

In addition to Morbi Print City catering to the wide-format segment, there are six more players in the fray, two of whom are hoarding contractors.

While the commercial print firms in Morbi are able to cater to most print jobs, extra special jobs or jobs needing bigger size prints are sourced from nearby cities like Ahmedabad and Rajkot.

One such printer is Rajkot’s Printwell Offset, which has recently installed a brand new Heidelberg CD 102, five-colour plus coater press.

But when it comes to packaging, the ceramic industry stands defiant on the quality. Morbi’s packaging industry which produces only litho-laminated corrugated cartons is a price sensitive segment.

“The packaging for ceramics is just to add to the safety of the products during transit so the print quality of packaging is of least importance,” says Patel of Face Ceramics. “It is a volume-based business and low-quality and low-price is the funda.”

Morbi boasts of around 50-plus very large-format (VLF) presses, a combination of one-, two- and four-colour presses. All these presses are refurbished or secondhand specifically doing packaging work. We were informed that each press produces 5,000 to 8,000 corrugated boxes per day.

The packaging firms use conventional PS plates which are developed in-house. Morbi is devoid of CTP systems.

Morbi has 20 paper and pulp mills, catering to the packaging demand. Paper requirement for printing of commercial jobs are sourced from ITC and BILT.

Ceramic industry – the digital era

Currently the ceramic industry of Morbi is in a phase of digital revolution. Since last couple of years the ceramic units have started shifting from conventional screen printing on ceramics to digital inkjet printers.

According to Patel, Morbi has the highest density of digital printers at least for ceramic printing in the world with more than 250 machines. All these 250 digital printers have come into Morbi in the last three years.

Patel says, “Today, 15 machines are in pipeline. The screen printing technology for ceramics is on the way of extinction. Six months down the line, everything tile in Morbi will be digitally printed.”

Patel has installed Cretaprinter, the digital ceramic printer, six months ago. Explaining the advantages of digital technology, Patel says, “Not only does it enhances the production capacity and quality but also it reduces wastages, labour requirements and allows us to print on tiles with uneven surfaces which has huge market demand. Also, it helps us to supply more than a few design options to the clients”

Atul Gandhi, managing director of Macart, manufacturer of wide-format equipment is of the opinion that though the machine cost ranges from Rs 1.8-crore to Rs 3-crore, the average return on investment is six to eight months. “With most ceramic looking to switch over to digital, and the life of these printers being 3-4 years, the demand for digital printers in the ceramic segment is only expected to grow,” says Gandhi.

Vimal Patel of Morbi Print City with the Newtech’s Nova jet wide-format digital printer

The other digital print equipment supplier we spoke to was Ahmedabad-based Arrow Digital, which has played a role in the wide-format graphics art industry, has now diverted its attention to the ceramics and glass industries. The firm has launched a new firing printer and a special range of inks, for this growing segment. “We along with Kerajet have recently launched a 12-colour printer with multi head technology, capable of utilising regular colours along with special effect inks, for the next phase of tiles,” said Nazreen Wadia of Arrow.

Though the industry is currently at its low, according to Patel, the industry has seen 20% year-on-year growth since 1996. Face Ceramics which currently has a turnover of Rs 200 cr is expected to reach Rs 1,000 cr turnover in next five years.

Raju Patel: “We spend Rs 25 lakh, which is 1% of our Cermaic turnover, on printing and packaging

requirements“

(l-r) Naresh Aghara and Jasmin Patel with a five-colour Heidelberg CD 74

Patel adds, “If we have to exist we need to invest. This digital revolution will take Morbi a step ahead in terms of quality and production capacity to cater to the international ceramic tile demands.”

See All

See All