500+ units per year, 50% repeat customers and 3,000+ units by the end of 2016, Konica Minolta is on a roll - The Noel D'Cunha Sunday Column

Konica Minolta’s Yoshinori Koide, executive general manager (PP and IP marketing), says, growth for the company is not selling 10-20 units, but 500-600 units. “We may not be 100% happy about what we are doing but we have been quite happy about the success what we are having in the Indian market. We believe we are growing the fastest when compared to our competitors”

In this Sunday Column, Koide along with Manish Gupta, national manager – PP and IP Marketing at Konica Minolta talk about

20 Aug 2016 | By Noel D'Cunha

PrintWeek India (PWI): What’s been your proudest achievement in the Drupa year?

Yoshinori Koide (YK): We have successfully launched the KM-1 at Drupa. It’s the first Konica Minolta inkjet B2 size machine that we have launched after it was first shown as a concept four years ago at Drupa 2012.

PWI: How was the beta experience? Have you installed any machines?

YK: Yes. The customers are happy. There were improvements along the way that propelled an improved level of quality that our customers were expecting.

The KM-1 has been launched in the US, Europe, Japan, and we are preparing for its India launch.

The UV sheetfed digital press KM-1 launched at Drupa

PWI: So, in terms of readiness to actually to put into 100% use, where are you right now?

YK: As per the feedback from the customers and our Japan office, the output meets the expectations of the customers’ needs. This means we are on track.

PWI: With around 70 installations of the FujiFilm JetPress in Japan, you have a real challenge in the B2 inkjet space in India?

Manish Gupta (MG): FujiFilm has been selling JetPress for quite some time now, but we are new to the market. What we bring to the table is the B2-plus size. This means for PSPs who have applications in A4 size or letter size, will find the KM-1 more economical to run. The KM-1 will offer six-ups compare to the four-ups in our rival presses and most importantly the media does not require any pre-coat.

As for competition, I don’t see the JetPress being a direct competition at this point in time. Besides the size, we have an advantage like direct presence in India, and the confidence of our digital success in India. We have a different ink set as compared to the JetPress.

PWI: Who are the typical customers for KM-1? Which is the category of customers that you are looking for?

YK: From the profile of those customers who have shown interest in the machine, I don’t think we would like to limit ourselves to a particular segment.

At this point, we do understand there is potential in commercial printing segment, packaging, and publishing.

PWI: Which are the types of customers who were presently running the KM-1 beta?

YK: I understand it included commercial, photo and a mix of those applications. I also understand that these customers are engaged in a variety of applications.

MG: In the US, we have already crossed the beta stage.

PWI: Does the tier-two and tier-three cities in India command growth?

MG: Yes, we have been growing in the tier-three cities. In terms of percentage growth, it’s higher in both tier-three and tier-two when compared to a tier-one city.

PWI: Which is your popular press model?

MG: We have different customer segments and it depends on it. The customers who have volumes below 25,000-30,000 print copies, we have the press C1060, the most popular model. Among the presses who want to upgrade, we have C1085.

PWI: Has any machine matched the Bizhub C6500 success? In the first three years or so, you touched the 1,000 mark. Have you got that kind of response for any of your other machines?

YK: The C6500 was a first-generation machine with which Konica Minolta made its entry into the production arena. As time passed by, the C6500 evolved as C6000, C7000 and so on.

MG: It’s true that with the C6500 we have a better response initially, but recently we have received a good response to the Bizhub Pro C1060.

Moreover, now we have more products so it won’t be much in the news. We do have higher models as well, besides we have established ourselves in the photo segment too with the most number of equipment being sold to the photo labs in India.

The Bizhub Pro C1060

PWI: What’s your total installation base in India?

MG: By this year half end we should be touching 3,000 installations in India.

PWI: Okay, so which is your most popular model right now?

YK: Our customers began with the C6500 and as the print demand increased, they have migrated to bigger machines like the Bizhub Pro C8000 and Bizhub Pro C1100. Within India, the C1100/C1085 is the most popular series in the mid production and amongst the entry level production printers, Bizhub Press C1070/C1060 is the most desirable product.

PWI: How much of your business comes from repeat customers?

MG: In terms of repeat customers, we are selling 500-550 machines a year and more than 50% of these go to our existing customers.

PWI: There are some new faces coming into the industry, those who are not connected with print are making their foray into the industry with digital machines. Who are these people and why they are coming into the print industry?

MG: We have been trying to get all their information. Yes, it is an important factor and we motivate other people to join this industry as well.

We see such traction in the photo segment. While there are now players in this segment, many are studio owners.

PWI: When you move to second- and third-tier, how do you service your customers? How are the technical supports sent out to them?

YK: Sales is much easier but having a technical support system is more difficult. The technical support is growing as compared to sales side. We have depots for servicing the customers. Nationwide we have 16 branch locations. As and when sales increase, we increase our local service staff too. We have more than 26 warehouse locations for service parts and spares.

MG: We have a different system of monitoring the machine when the machine is down and not working.

PWI: In terms of activities what do you plan to do in the next six months? Moving into wide-format and new segments and segments which are unidentified or maybe a year later or two you will be planning to do?

YK: In terms of India operation, we do have a different organisation that handles textile printing. As Konica Minolta, we have synergy with different organisations. The textile printing is out of the scope of the digital production division.

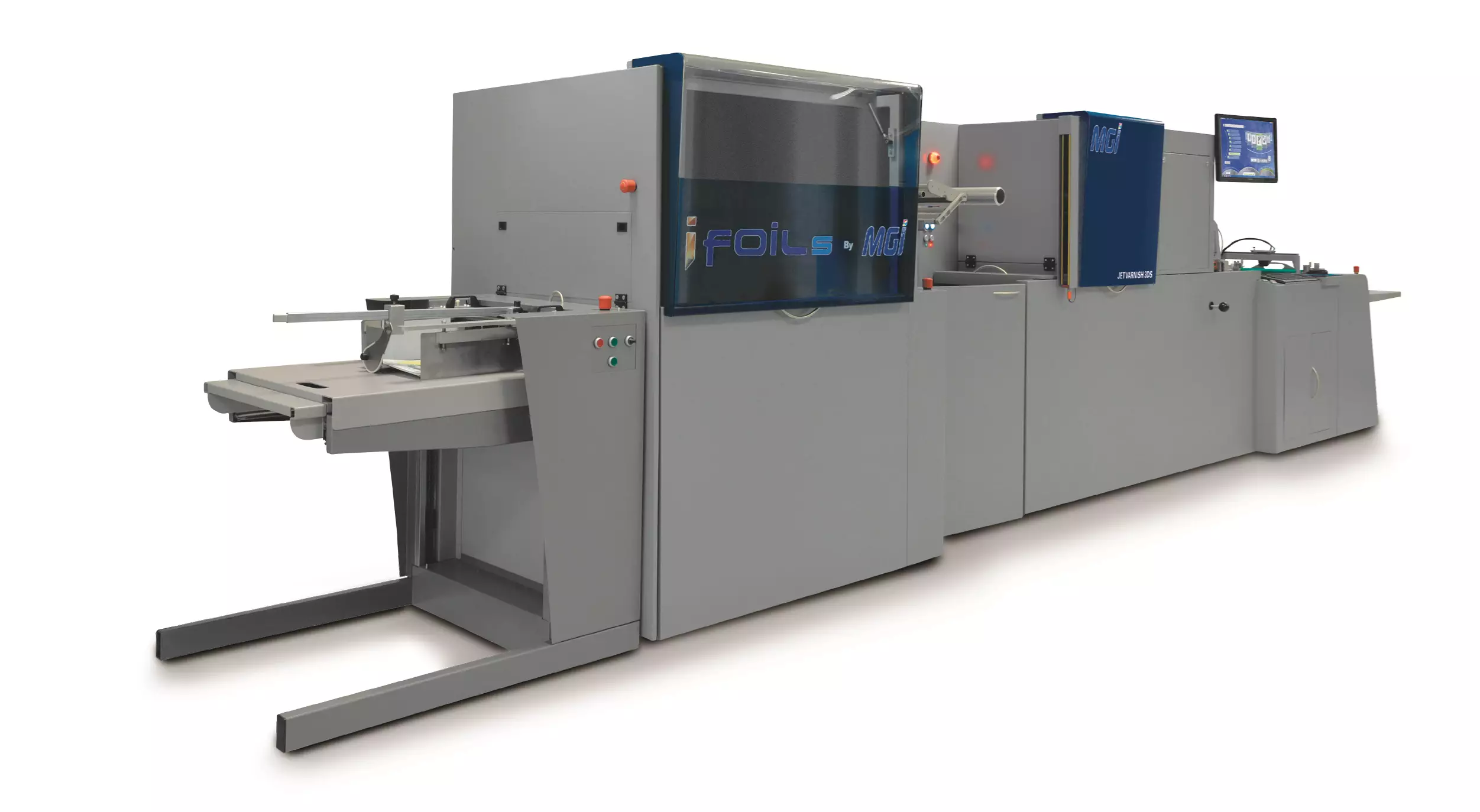

PWI: You spoke about synergy; you have stakes in MGI, which also uses Konica Minolta printheads?

YK: That’s another business where Konica Minolta Japan is involved. We have a bit of edge in providing these services and MGI is one of our key equipment. The value that MGI adds to the packaging and publishing segments is something which we are looking to leverage.

We have been selling MGI machines but we did not have a chance to look into the new businesses in past 12 months because of the business alignments that took place last year. Then our focus was on stabilising the organisation. This year we are going to expand our business, customers, and services.

In the coming six months we are looking forward to the service part and may be web-to-print services. With MGI, we can provide more value to the customers. We are also seeking more line-up, may be wide-format.

Konica Minolta installed India's first Jetvarnish 3DS at Dina Color Lab in Chennai

Konica Minolta installed India's first Jetvarnish 3DS at Dina Color Lab in ChennaiPWI: Will web-to-print be an in in-house development?

MG: Yes, partly. We have a tied up with a company to facilitate the W2P services.

PWI: What’s your team’s favourite print success story among small business units?

MG: The photo studios, right from taking the photos to the delivery of the photobook. It’s an interesting story for them. Some of the small time jobbers, who were earlier getting into production coloured business with C1060 and C6000, they have slowly emerged into becoming bigger companies.

PWI: Is this industry still the male dominating? Or has it opened up?

YK: In South, you will find women operators but in North and East, it’s still the male dominating.

PWI: In one of our previous discussions, you mentioned about Ahmedabad being a different market? What does it mean?

MG: Ahmedabad, in fact, all of the Gujarat market, is a very price conscious market. The volumes that they do are very high. Including Konica Minolta, other companies too have the thinnest market. Most of the customers are doing offline finishing, as digital finishing has limited capabilities.

PWI: There was a presentation by Konica Minolta at the NPES event and in that the numbers were being tracked. The 2008 and 2009 were your best years and after that, it was a single digit growth. When will you return like 2008 and 2009 in India? It was almost 700-800 units. There has been a slowdown with most of the companies and are we going to see a pick again like 2008 and 2009 numbers?

YK: Growing with 10-20 units and growing 400-500 units are two completely different thinking. Right now we are at a level of 500 units. Among the market, we believe we are growing the fastest as compared to other competitors.

We may not be growing as compared to five years ago. We may not be 100% happy about what we are doing but we have been quite happy about the success that we are seeing in the Indian market. Last year was quite good.

PWI: What is your USP?

YK: One of the strengths which I personally see in Konica Minolta is our stability. In the last five years, we have started a distribution model. We have been growing in terms of our organisation, operation, customers, and profits.

We have invested in this market and have reaped the success.

See All

See All