Indian label industry- cautious, but still growing

I have always been of the opinion that there is nothing as stagnation in an industrial enterprise, more so in the Indian label industry. There is either growth or recession. Anything that stagnates starts to deteriorate.

25 Mar 2014 | By Harveer Sahni

Growth or change is inevitable and an imperative part of any enterprise. Fortunately for a country like India with a large and numerically enhancing young population achieving increasing literacy levels, the demand for consumer products will continue to grow steadily. This growth in consumerism is obviously expected to give fillip to the already growing organised retail. This may witness exponential expansion of the retail sector if FDI in multi-brand retail begins to happen. All this will definitely drive growth in the demand for labels.

The industry maybe facing momentary slowdown due to circumstantial situation, but on a ‘year-on-year’ basis the label industry continues to register a near double-digit growth. The slowdown in the manufacturing sector is expected to end and the economy is slated to lookup once a new stable government takes charge at the centre after general elections. India has no dearth of investors who drive growth in an industry that registers automatic growth consistently.

All growing industrial segments do experience the entry of new entrepreneurs besides the expansion moves from existing companies. There are at least three types of expansion initiatives in the Indian label printing industry. First, it is the existing printers who, in response to the need of their natural growth, have to invest in new capacities. Secondly, it is the commercial offset printers facing slowdown due to the impact of internet, who are expanding into the label industry which is growing. Then, it is the new investors who are flush with funds, maybe due to some real estate deals, who have no knowledge of printing but on hearsay or with prospective partners, make investments in label presses. With investments growing in an unregulated environment, it is likely that there is creation of excess capacities. The pressures to break even for the new entrants into the industry escalates and they start making desperate sales bringing down prices and putting margins under pressure. This creates difficulty for existing established printers.

As a result of this situation we find printers complaining of a slowdown and difficult situations arising out of haphazard capacity growth. Despite such situation, the label market has over the years segmented substantially and each segment has individually started to branch into its fields and register growth to contribute to a situation such that when we review it on a national level, the label industry shows up definite growth both in capacities and investments. However due to reasons explained herein, the industry is cautious but still growing.

Segmentation of the self adhesive label industry is a very important part of its growth and evolution.

In the earlier years, a label printer would indulge in all types of stickers. These include plain stickers, printed, hot foiled and decorated labels among others. With passage of time and investments being made in high-end equipment, it has all changed. The sticker became an engineered product called label. Size of the label industry is measured largely by the amount of labelstock consumed by it. The industry is segmented into various segments like the plain labels or variable information labels, pharma labels, product (FMCG) labels and the innovative/security/special labels.

Strange as it appears the largest consumption of labelstock comes from a segment that has the least investment in equipment and the least margins. The plain label or the VIP label segment producing price labels or gun labels, A4 labels and barcode labels accounts for the largest share of labelstocks consumed in self adhesive labels. This also is the segment that has the lowest margins due to less value addition.

Converting these does not really need very high-end machines with enhanced capabilities, neither does it need the expensive slitting and inspecting equipment. Most of the time converters just die-cutt and finish. These converters are always under pressure to drive in large volumes to stay afloat due to depressed profitability. With low initial investments and because of new entrants into labelstock manufacturing ready to fund their working capital needs with required raw material on credit, there is a rapid growth in the number of entrepreneurs in this segment. It is interesting that with so many new entrepreneurs, even though in the micro and small sector, are likely to settle down and start growing to higher levels providing further impetus to the growth of label industry.

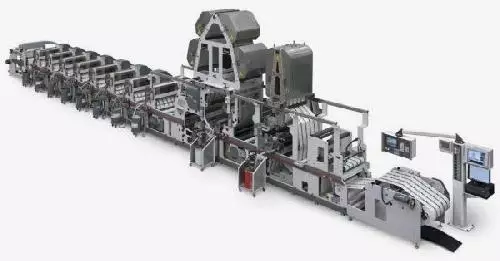

The pharmaceutical labels and product label segment is perhaps the face of the self adhesive label industry. It is responsible for producing the highly engineered, converted and decorated labels. This segment accounts for bulk of the investments made for acquiring sophisticated European and American branded label presses. The label printers make huge investments to upgrade their capability not only in printing but also in expensive inspection and quality enhancing finishing equipment to meet the exacting demands of their customers.

It is these days a difficult situation for the established players when they are pitched against new entrants who in their efforts to service their investments are ready to forego margins and create intense competition in the marketplace. This makes it difficult to justify return on investments. This may appear to be a win-win situation for the print buyers. However, in the long run these new entrants may not be able to sustain their customer’s demands for quality control, tight schedules and short runs that cannot be catered to, in view of reduced margins.

The pharmaceutical sector has in recent times faced slowdown due to circumstances at a global level, however, in view of the growing health concerns of a large population locally, this sector cannot remain down for a long time. It is thus that printers continue to invest even while exercising caution and restraint.

The top end of the label industry these days seems to be the forte of a miniscule segment that is foreseeing high growth and higher margins. It also is attracting the highest investments in equipments with multiple capabilities in combination printing processes, decorating and diverse converting methods. For obvious reasons there appears to be less competition in this segment.

This segment is perhaps the most innovative for its indulgence in creating products that stand apart from the mainline products. Some of the label products that this segment offers are high security labels, booklet labels, lottery labels, document security etc.

Printers in this segment have acquired and continue to acquire additional capabilities like producing linerless labels, online siliconising and gumming. This enables them to print subsurface or on surface. The equipment they possess has capabilities to shuffle between self adhesive labels, shrink sleeves, lamitubes and folding cartons. They have access to diverse printing and converting capabilities on their expensive equipments.

At this time it is interesting to note that with the advent of indulgence in flexographic printing in self adhesive label industry in India, indigenous production of narrow web flexo presses commenced in the early nineties when an Indian entrepreneur Baldev Singh Jandu developed a flexo rotary label press. These machines catered well to the gunlabel (price label) segment and later with growth of barcodes to barcode labels segment.

Jandu Engineers have been consistent in sale of their label presses and have created a very specific segment for their product. On another scenario, since there was a definite segment for flatbed label presses created by the earlier Japanese presses and since it was a lower investment as compared to rotary western equipments, Indian printers invested continuously into these flatbed presses. Also given the fact that flatbed dies were much cheaper as compared to flexible dies used in rotary presses, these presses were popular. Ahmedabad-based R K Label machines saw a market potential in this segment and developed flatbed machines that found a ready market.

So successful were they in their venture that at the last Labelexpo India, they claimed to have sold almost 700 machines till date. With rising prices of high-end label presses from the western world, Faridabad-based Multitec developed their flexo rotary modular label press so as to find acceptability in comparison to the imported equipments. It is credible that the press has found acceptability with established printers like Update Prints, Syndicate Labels and Kumar Labels.

A satisfied Aditya Chadha of Update, says, "We have recently installed an eight-colour Multitec flexo press and are satisfied with the performance. It offers stability at high speeds, smooth production and flexibility to print on various substrates.” Multitec has also successfully exported many of its presses. An industry that was initially dominated by European, American and Japanese has gradually shifted equation. Mulitec has created a segment by successfully offering an acceptable alternative to Mark Andy 2200. While the European and American presses have maintained a steady presence yet the market has a very obvious presence of Chinese, Taiwanese and Indian label presses.

Over the years, with need for faster machines and evolution of flexo printing process, the shift from letterpress to flexo is evident, gradual and steady.

Over the years, with need for faster machines and evolution of flexo printing process, the shift from letterpress to flexo is evident, gradual and steady.With growth in demand for flexo printing label presses, soon many branded rotary flexo machines started coming to India. These were mostly from Europe or USA. These presses have over the years carved out a definite market for themselves. Brand names like Mark Andy, Gallus, Nilpeter, Omet, Gidue, Rotatek, MPS, Edale, etc are dominant in the label industry now.

The Indian label industry is now extremely diverse in its spread across the nation. I have attempted to estimate the number of presses installed in the preceding year. It is my personal estimation after interaction with industry peers and machine suppliers. I have also relied on press reports.

Samir Patkar, managing director, Gallus India has stated earlier at Labelexpo Europe 2013 that Gallus had sold nine presses in 2013 and hoped to close the year with 10-11 press installations. Manish Kapoor, sales manager, Nilpeter India confirmed sale of six Nilpeters. There are other sales made by Mark Andy, Omet, Gidue, etc. According to Gaurav Roy of FIG, who represent Mark Andy presses, they have sold eight presses in the last one year. Says Gaurav, “We have over 150 Mark Andy installations in India. The trend is changing now. With printers opting to buy the high-end performance series, the number of installations per year maybe coming down but the value of equipment has risen.”

In my personal opinion about 30 label presses from the established Western suppliers have been installed in India in the last 12 months. Ahmedabad-based Manish Hansoti selling Chinese Zonten presses has informed sale of five flexo presses and 13 die-cutting machines.

Though the die-cutting machines cannot be termed as label printing presses yet they contribute to the usage of labelstock and eventually growth of label industry so I will include them in the grand total of label converting equipments. Installations made by the Amit Sheth led Label Planet and their Asian principals are almost 14 Weigang flexo presses and 25 rotary die-cutting machines.

As for the Indian press suppliers Jandu has sold 12 presses. Ahmedabad based R K Label Machines says they have sold a total of 22 label presses, which is a mix of flexo rotary and flatbed. According to Amit Ahuja of Multitec, they have sold a total of 16 presses out of which four have been exported. There are other Indian machine suppliers but their contribution is miniscule. I estimate the total no. label presses and die cutting presses that would convert labelstocks into labels is in excess of 140 that would include other local presses and the used presses coming in.

Out of this grand total more than 50 machines are plain die-cutting presses but as I mentioned earlier, since they play an important part in the total usage of labelstock in India they have to be considered in estimation. Moreover it is the basic entry point at the micro level for people entering the label industry.

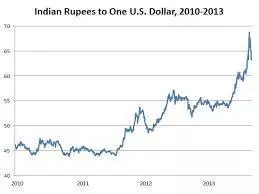

The Indian label industry would have ended the year on a very positive note and registered higher investments and growth rate but for the exchange rates having played a spoil sport. Before the Labelexpo Europe last year, all looked very good but when the Rupee fell by almost 15% making equipment costlier, label printers put purchases on hold and also many of them put off their trip to Brussels. Another factor that has been responsible for slower growth is the political unstability of the central government facing the nuances of coalition politics.

Also FDI going on hold in anticipation of stability after the general elections this year, impacted the economy adversely. However still the Indian label industry is moving ahead with caution, to achieve growth and cater to the market that still has a lot of potential.

Written by Harveer Sahni, managing director, Weldon Celloplast

See All

See All