Tanvi Parekh looks at how India’s airlines spend money on in-house magazines; and how this small elite has created a successful business model for a raft of titles

The Indian airline industry, after being in a beleaguered condition, is resurfacing. IndiGo, the low-cost carrier has turned in stellar performance to secure a walloping 27% market share. Jet Airways, has posted a profit of Rs 24.7 crore and holds the deux position with 26.6% share, followed by Air India with 18.2%, SpiceJet with 17.8% and GoAir with 7%. The former number two; Kingfisher, however, is tumbling down the profit chart with a meagre 3.4% share.

Basking in this reflected glory is the Indian publishing segment for its fleet of in-flight magazines. PrintWeek India traces the trend of airline magazines; the maiden exemplar of custom publishing.

In-flight magazines: An overview

All flights have the customary beverages and cookies rounds to keep the passengers engaged and in-flight magazines play a huge role in the entertainment! Some big airlines, especially the international ones have some geeky in-flight entertainment gadgets, too. However, the magazines are picked by most (for a look-see, at the very least) through their journey, especially on the longer routes.

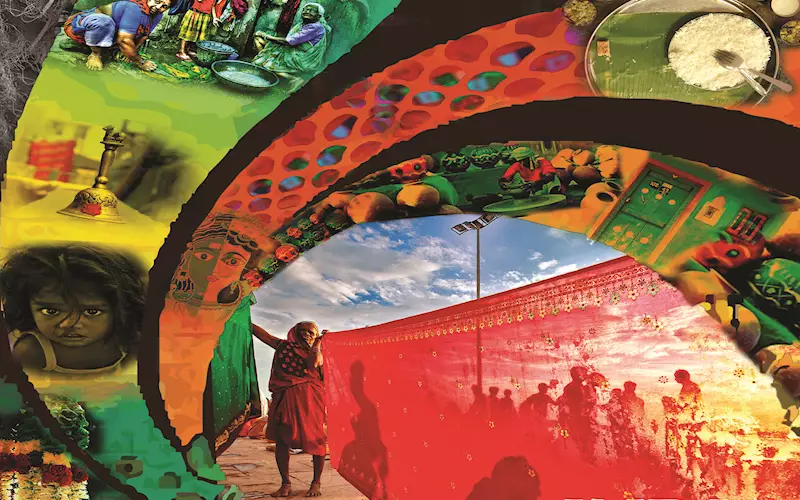

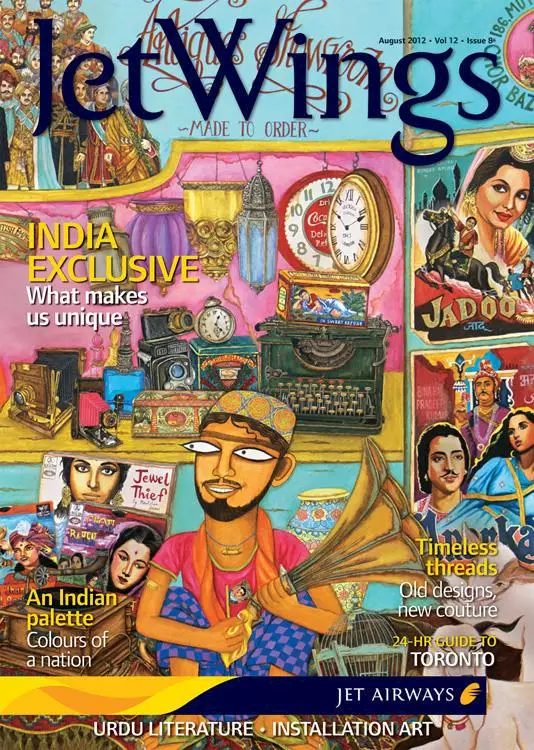

Spenta Multimedia’s JetWings and JetWings International adorn the Jet Airways flights for about 18 years now; a glory story for the in-flight publishing segment. “We have been associated with Jet Airways as its in-flight magazine publisher for almost 18 years. The magazine reaches out to over 23,50,000 passengers a month, both on the domestic and the international sectors, says Maneck Davar, proprietor, executive editor and publisher at Spenta Multimedia.

Radhakrishnan Nair

Radhakrishnan Nair, editor and publisher, Man’s World, has been publishing Go Getter magazine for Go Air since three years with a print-run of 75,000 copies. “We created and published Simplifly, the inflight magazine of Air Deccan for five years.” Simplifly was discontinued after the airline was taken over by Kingfisher.

With the merger of its two airlines, Air India has consolidated both magazines: Swagat (for Indian Airlines) and Namaskar (for Air India) since June 2011. Maxposure Media Group publishes the bi-lingual Air India magazine and Spiceroute for Spice Jet.

“We have been allied with Spice Jet for two years and 1.3 years with Air India and produce 1.65 lakh copies of Spiceroute and 2.25 lakh copies of the Air India magazine each month,” says Prakash Johari, chief executive officer and managing director of Maxposure.

Prakash Johari

In-flight magazine: Unhampered bottomlines

The Indian aviation industry is recuperating from its sluggish performance. The airlines have added new routes and greater number of airlines on their charts.

The market leader, IndiGo, has expanded its capacity by 29 per cent between October, 2011 to June, 2012. Spice Jet has upped its ante with newer flights and today operates in 34 airports in India compared with the earlier 22. It has replaced the unprofitable destinations with the requisite number of flights in profitable destinations.

While, the aviation industry continues to grow, is something to sit back and watch for, the supremos of the publishing segment implicitly trust their eclectic content and marketing gimmicks for unaffected bottomlines.

“Inflight magazines tend to follow the trends of the media in general. The inflight magazines have grown with the growth of airline industry. They are not impulse purchases like the stand-based magazines. Every flight has a captive audience for the magazine, an audience that will not go away anytime soon, particularly for short haul flights. In long haul flights they do have a choice of the audio-visual entertainment,” says Nair.

Davar shares the optimism. He adds, “The content, design, marketing of advertising space and printing is handled by us. By dint of hard work and clever marketing we have managed to grow revenue year-on-year. The advertiser realises that the core group of passengers will always travel regardless of the economic conditions.”

Tracking the trend: in-house operations

A thorough understanding of the target audience and an unconditional commitment of timely delivery is the crux of niche publishing. With a spate of titles in their stable, some publishers have an in-house printing facility to their advantage. The custom publishing space demands strategic and optimum resource management. In-house printing offers the publishers flexibility and an edge over their counterparts.

For Spenta, it is a ‘total-control’ module. “The content, design, marketing of advertising space and printing is all handled by us in-house,” states Davar.

Maxposure, on the contrary, adopts a distinct strategy. The publishing house outsources its operations to Thomson Press in Delhi and Rajhans Printers in Bengaluru. This, says Johari, is because of the high print quality the two presses offer. “The magazines, beginning with the content to the advertisement space to the distribution are monitored by us. Outsourcing the printing is a well thought-out strategy, leaving space for the conceptualisation of newer titles.”

Still growing...

The Indian aviation industry and the publishing segment adopted some radical changes succumbing to the drop in the demand of the carriers in 2010-11. While the former is tardily unshackling from the trying spell, the publishing segment is growing.

Magazines comprise around 19% of the total publishing industry in India. The Indian magazine industry is guesstimated at Rs 1,300-crore, according to the Federation of Indian Chambers of Commerce and Industry (FICCI) and a KPMG joint-report. The general content magazines are witnessing a decline as readers demand more focused content. The niche magazines are increasing in readership with new genres like automobiles, banking, healthcare, travel and lifestyle. The industry has become fragmented and highly competitive with three to four titles for each niche category.

The segment is witnessing the entry of various international titles despite the global economic recession, Atelier and Robb Report, a few to name. Magazine players are moving towards alternate revenue sources such as events, activations, online lead generation and digital media platforms. “The industry is focused on English language publishing and this in itself is a very small piece of the overall market. The unfortunate part for magazine publishers is that while regional newspapers are increasing their reach and profitability, this is not happening for magazine publishers in regional languages. The big magazine publishers cannot adapt to low cost custom publishing. Each publisher will have to evolve his own strategies to survive, if not prosper,” concludes Davar.

Furthermore, with the expected increase in the FDI limit in both newspaper and magazine industry from 26% to 49%, the publishing segment will continue to grow.

|

Airline Traffic: The New Pecking Order |

|

|

Market Share in % |

|

Carrier |

July, ‘12 |

June, ’12 |

Fleet size |

|

IndiGo |

27.0 |

26.0 |

58 |

|

Jet |

26.6 |

27.4 |

101 |

|

Air India |

18.2 |

16.8 |

100 |

|

Spicejet |

17.8 |

18.6 |

47 |

|

GoAir |

7.0 |

6.9 |

13 |

|

Kingfisher |

3.4 |

4.2 |

20 |

Custom publishing at a glance

Acquiring the publishing rights for a fixed tenure on contractual basis, the publishers form a long term association with the airlines and their readers. The government’s nod to open markets saw considerable bullishness in the Indian publishing segment. Custom publishing picked up and the Indian magazine publishers trudged from ‘long print-runs, general interest and an unknown audience’, to ‘limited, exclusive and target-specific’ publications. Today the Indian market is flooded with custom titles across banking, hotel, automobiles, retail, travel and hospitality among others.

“Publishers should print the magazines which target segments associated with advertisers to create an engaging and profitable product,” says Johari. “The advertisements in a custom magazine are expected to give the advertisers an undivided audience compared to its general competitors.”

“We are concentrating a lot more on custom publishing. The advantage of contract publishing is a ready-made audience and hence the cost and efforts of promoting a magazine is negated, states Davar. “However, the main disadvantage here is that relationship between the client and publisher can be very fickle. We are in a pre-eminent position only because of the quality of the product and service that we provide.”

An industry watcher says, “This is an exciting space. But we need genuine reform. Right now, it’s a slow lumbering march, it can be boosted with aggressive stimuli.”

|

Maneck Davar - Spenta’s 360 degree model |

|

Spenta Multimedia has bagged the PrintWeek Consumer Magazine of the Year 2012 title at the fourth edition of the awards. The group’s profile spreads across 40 customised and seven consumer titles. JetWings, The Chartered Accountant Journal, Apparel, Solitaire,First Update, Imperia, @TCS, Priority Pages, Milestones, Shubh Labh are some of the titles.

Furthermore, Spenta is in the process of expanding its print facilities in Ambernath with the addition of a Mitsubishi Diamond web machine. The investment will boost its capacity to give the group an output of over one-lakh 16-page forms an hour.

Expanding its presence, the house is developing capabilities in online, book publishing and events with custom publishing at the core.

Davar says, “Spenta Multimedia is a proprietary firm and our funding is through internal accruals and bank borrowings. The key is to ensure that the debt is in a very healthy proportion to the physical assets and receivables. The 25% growth, clean budgets, no hanky-panky, loyalty among the 200-strong Spenta family, and sensible working hours is what we are aiming at.”

|

See All

See All