Trillions of boxes and growing - The Noel D'cunha Sunday Column

The corrugated packaging industry in India is steadily growing at 10% per annum.

22 Oct 2014 | By Noel D'Cunha

Kirit Modi, who is president of Indian Corrugated Case Manufacturers Association (ICCMA) says, "The corrugated packaging industry would grow between 12‐15% p.a. in the next five years. The e‐commerce, automotive sector, export‐oriented units, fresh farm produce etc are the major user industries which would contribute maximum growth impetus."As per a study by Ram Kumar Sunkara, the chairman of R&D Committee (FCBM), "The annual production of corrugated boxes in India is 4.60 million tons. Interestingly enough, five plants with a captive consumption of more than 15,000 TPA are producing 10% of the boxes in India."

The 225 automatic converting plants cater to more than 50% of the market which is dominated by big players like HUL, Pepsico, LG, Samsung etc.

In addition, there are 2750 semi automatic lines. To put it in plain terms these would be lines with a single facer and no automatic splicer.

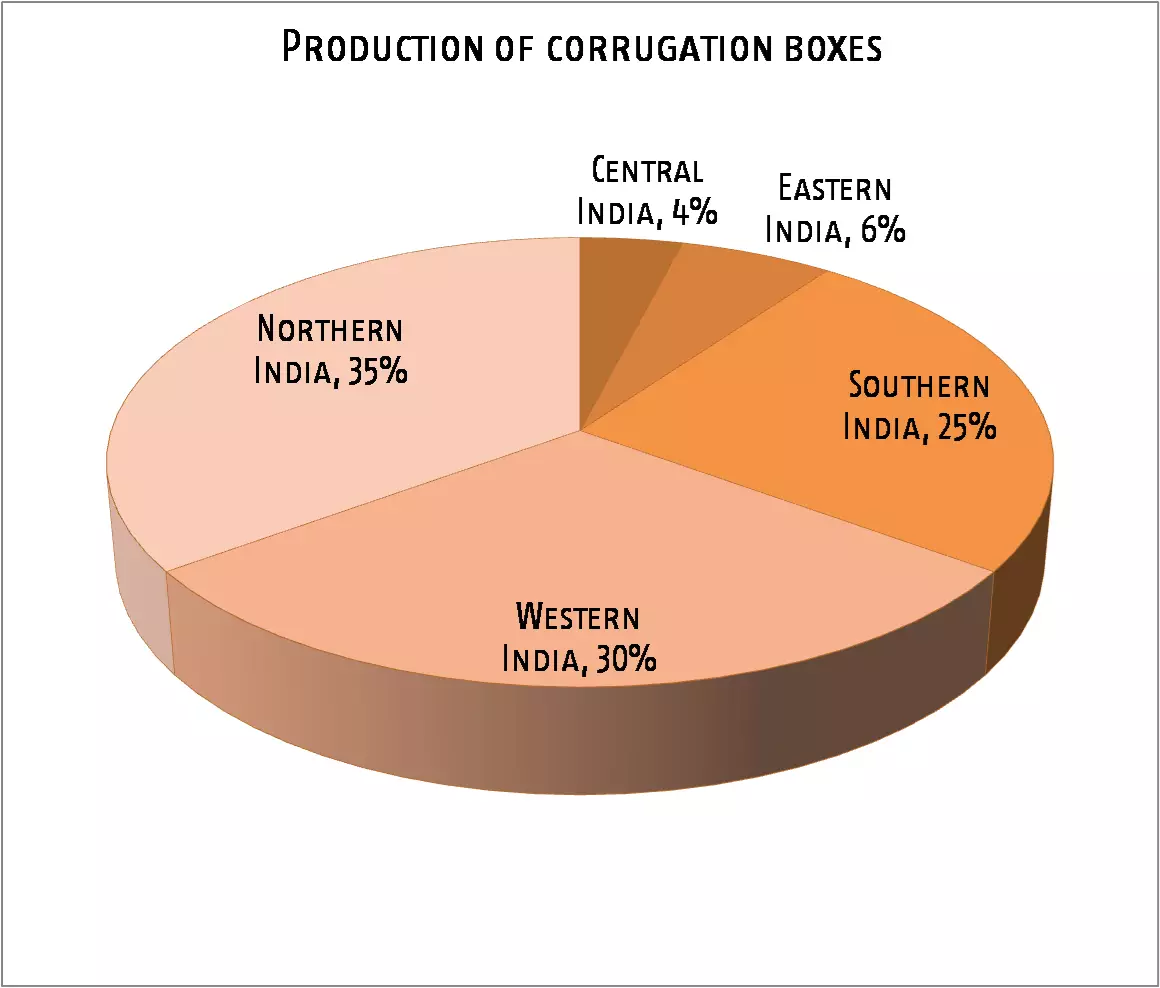

The present status in India and region wise break up in terms of production of corrugation boxes is:

Where we stand

This is onerous when one looks at the prevalent technology.

The technology trends are:

- Most printers are two-colour

- Maximum number are chain feed printer with speed of 20 to 45 impressions per minute

- Most higher speed automatic plants having two colour lead edge printers with speed from 100 to 150 impressions per minute

- There are very few high speed fully automatic printers having speed more than 250 impressions per minute

- There are few case makers around.

The box manufacturing trends according to the FCBM survey are:

- More than 50% of the market is still using stitching as manufacturers joint

- There is a trend for customers using 3 ply cartons to switch over to glued joint but process of switching over is slow

- Most stitched joints are done using manual stitching machines

- There are about 200 semi automatic stitching machines in operation

- There are about 100 auto folder gluers operating.

- There are about 30 auto folder stitching machines

To sort out matters, some key converters have mooted the following:

- Kraft mills are consistent in giving the Burst Factor, which has been the traditional parameter

- But new generation box buying is based on compression strength which requires paper to have RCT value

- The mills have yet to fine tune the process for manufacturing paper with consistent RCT values

What the customers say

To ensure a discussion on technology, ICCMA invited top brands like HUL and Godrej, paper mill representatives and corrugated box makers. Kirit Modi said, "The aim was to move from material standards to a performance based index."

Yeshukant of Hindustan Unilever Limited (HUL) made opening remarks in which he informed that HUL has been practising performance based buying for last one and a half year. He said, as a brand when we attempted to adopt performance based parameters, we faced an issue of lack of leadership which is critical to drive this journey. It could be brands, it could be paper mills, or it could be box makers.

Mukul Kumar of Cargill said, "all stakeholders have to come together to build trust." He added, "there has to be harmonisation of standards." He struck an optimistic when he said "the situation was better than 18 months ago."

Sachin Chansarkar of Godrej also hoped that corrugation box manufacturing industry can standardise itself like the plastic industry.

Time and again, the representatives on the panel brought up the question, which standards must one deploy? Indian? ISO or Tappi? Many felt box making has immense constraints in today’s dynamic and volatile business environment. The complexities of compliance mandates, supplier and information flow is becoming more costly and making organisations more more and circumspect.

Lon Rollinson of MWV felt the entire supply chain is crucial. He said, there must be an attempt made to optimise measurements and tech specs. He felt the issues and challenges in the pulp and paper sector in India can be overcome to boost the performance of the box.

Conclusion

This can be understood better when one considers: The present status of an automatic plant output based on the average output per annum in tonnes % of automatic plants (for instance, a BHS or Emba line)

An automatic plant capable of 20,000 TPA constitutes 10 % of total production

An automatic plant capable of 12,000 TPA constitutes 25 % of total production

An automatic plant capable of 5,000 TPA constitutes 65 % of total production

Not long ago every piece of IT or electronic equipment would come in a massive box padded out with non-recyclable Styrofoam and bubble wrap. But things are getting better with, for example, multiple orders packed into single boxes, and a lot more thought is going into packaging materials.

Most of the top players seek a long-term sustainable packaging strategy. The plan includes increasing sustainable content in cushioning and corrugated packaging by 40% and ensuring that 75% of packaging is recyclable.

Today, the supply chain from paper to corrugated boxes, is highly fragmented. But with new monies being pumped into an automatic plant in Securipax in Roorkee or a new plant by Oji in Rajashtan, or the Kirit Modi group investing in Peenya, newer solutions are being found to the humble box. This could be much-more customisation; andsharing ECT / RCT value to guarantee standards.

(Special technical inputs by Tanvi Parekh)

See All

See All