Will the government’s effort to pull the economy out of the slump work? The Noel D'Cunha Sunday Column

Narendra Paruchuri, Pranav Parikh, Ashwani Bhardwaj respond to questions on the print market situation

22 Sep 2019 | By Noel D'Cunha

It's been status quo since 23 May, "no large business or growth" till December says the print industry.

Traders say: The economy will not be better at least for the next six months. This before the Finance Minister's announcement on 20 September 2019 which made the Prime Minsiter issue a statement. The PM said: "The step to cut corporate tax is historic. It will give a great stimulus to Make in India, attract private investment from across the globe, improve competitiveness of our private sector, create more jobs and result in a win-win for 130 crore Indians."

The government is committed to support MSMEs without compromising prudential lending. PSBs shall support stressed MSME loans till 31.3.‘20 without classifying as NPA. The Finance Minsiter has said, "This shall be strictly in accordance with RBI guidelines."

How long will it take to boost production is anybody's guess. At the moment, the print and packaging business is bracing itself with negligible growth.

The buzz on the paper front is not very good. Mills are under pressure for orders due to slowdown. Imports are competitive. The prices are soft due to slow demand and liquidity.

The president of a premier print association said, "Commercial printers are having a tough time due to spending cuts from corporate."

Some of the sectors which have hit the commercial printing and paper industry are:

- Real estate

- Textile

- Automobiles

I was talking to major packaging players. They say, even FMCG & Pharma are seeing a go slow on orders.

The Marwari and Kutchi community (in my view the most plugged into ground relaity) are hoping to see a demand revival in the coming festival season.

There is hope...

The refrain is: Let's see what happens now. The government has address the liquidity issue. Will the brands, big and medium-sized plus international and Indian, spend.

Everyone is praying for a great festive season (October, November, December).

Everyone is looking at managing costs/expenses better.

In these tumultous times, I spoke to three voices of sanity to get a sense of where we stand and what the road ahead, looks like ...

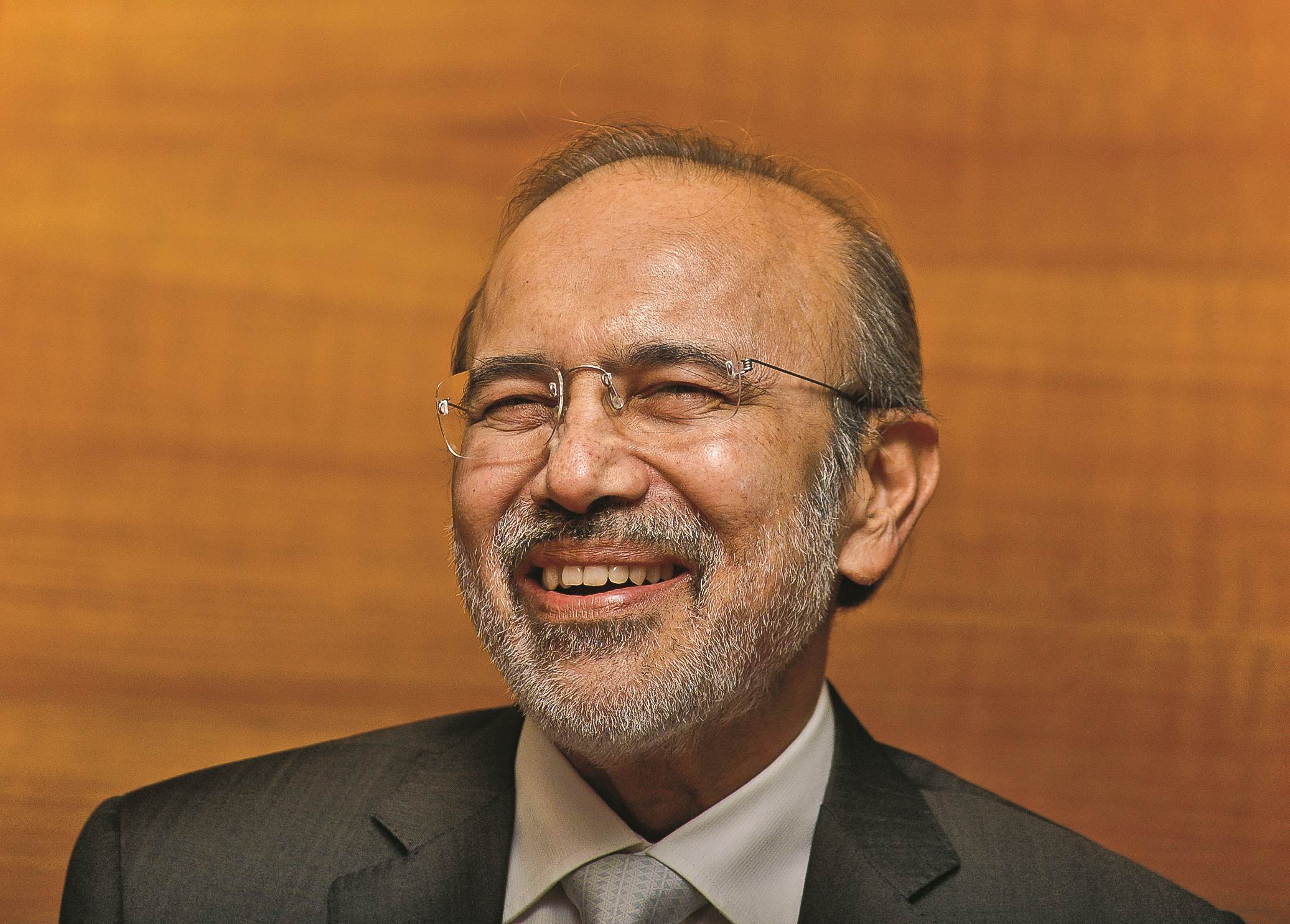

| Narendra Paruchuri, chairman, Pragati Group |

|---|

|

It is the cyclical nature of economics and happens again and again. But the last time it happened, in 2008, our banks were in a much better shape. Now they are in a mess. The market will have to pick up even if the government of India does not do anything. When, is a million Dollar question. As I said, it is cyclical. No one can give you a guarantee that the economy will keep on growing. It won’t. The ups and downs are natural. Please look up any economics graph. If you take a longer span of time, we see an undulating line going up. A very nice picture. But the same thing when viewed in a shorter time span will have so many hills and valleys. We have to be prepared for hills as well as the valleys. You cannot take decisions thinking that it is a one-way street. Sadly, it is not. What the elders said from a long time ago never changed. They said: Karcha Kam Karo, Zyda Karza mat lo, Control main Raho. Plan B for the worst that can happen. The latest jargon has changed a bit. Slow burn rate etc, etc. We must be in control of what we borrow. Can we repay it even if business goes down 15 to 20%? What can/might be the case if the worst happens, like now? Are we prepared for it? Unfortunately, we will live in a world where the bombing of oil facilities to Trumps’ tweet on China to Amazon fires has an effect on our economy and in turn us. No one can predict this. So we have to take a middle path and cover ourselves to the best of our ability. Growth rate might go down a bit, but at least you are happy and as such Healthy. I think that counts. Printing is a service industry We will do well if the industry, in general, is doing well. As the industry is doing poorly, it will directly affect the printers. The business will go down. So it is a good time to look at all the nooks and corners of the press, see what can be thrown away, what can be amortised, and what can be used. Anything which can add to the bottom line. Printers who did not borrow much are not in much stress. They will sail through. Working capital is also a big issue nowadays. Customers are taking the extra time to pay up, and that is creating a problem in keeping the wheel moving. I stopped looking at the charts, and economic prophecies and asked a saintly Guru ji. He told us to look forward to good times from around Deepavali time. So on that positive note in these gloomy times, I look forward. |

| Pranav Parikh, chairman and managing director, TechNova | ||

|---|---|---|

|

Your prescription is also very apt: Pray… manage costs… FM as Goddess Lakshmi! I cannot recall a time when the commercial print industry has experienced such a sharp and sudden dip in demand without a clearly visible and identifiable cause. One can explain away the causes as multiple factors mysteriously working together, such as: Demonetisation and GST reforms causing economic disruption (in the short term, with major long term structural benefits); surfacing of significant NPAs in the banking and NBFC sectors leading to liquidity crisis; steep credit downgrades of major corporations; international trade sanctions and tariff wars; absence of timely fiscal stimulus by the government due to its disciplined adherence to fiscal deficit targets; periodic crude price increase shocks; etc. all leading to loss of business confidence, abandoning of investment plans and focus on preserving cash… thereby slowing down engines of growth. What am I telling our team? I believe that the government is now tuned in and focussed on the economy… with rapid reaction times and quick execution of corrective actions. Therefore, I remain optimistic about the GDP growth returning to 6%+ by the first quarter of 2020-21… along with the return of business confidence and renewal of the investment cycle.

Please eMail me at noel@haymarketsac.com Has the industry growth slowdown impacted you? ⚪ There is no slowdown ⚪ Delaying investment decisions ⚪ Not as much of turmoil as other industries ⚪ Late payments and poor output prices ⚪ Concerned as to what’s will happen next |

See All

See All