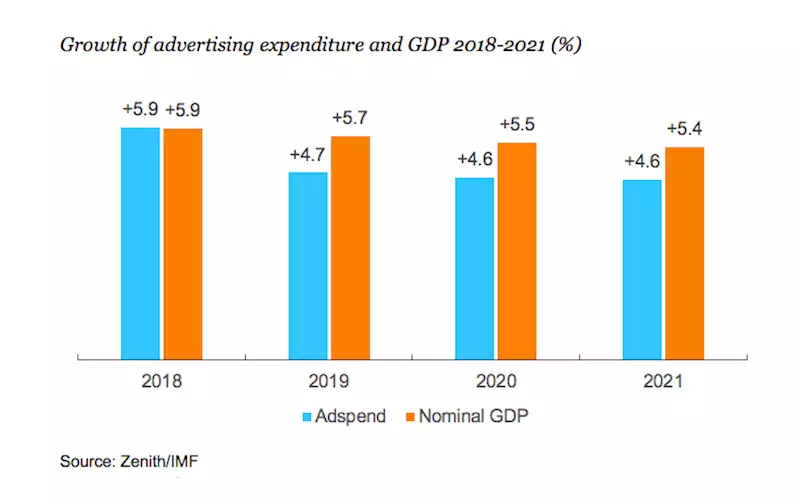

Global adspend to rise from 4.0% to 4.7% in 2019

According to Zenith’s Advertising Expenditure Forecasts, published on 25 March, strong growth in internet advertising will drive 4.7% growth in total global adspend in 2019, from the 4.0% forecast made in the previous edition of the report. The report also forecasts 4.6% growth in both 2020 and 2021, ahead of previous forecasts of 4.2% and 4.1% growth respectively.

25 Mar 2019 | By Dibyajyoti Sarma

The report stated that the jump is due to “internet adspend markedly exceeded our expectations in 2018. We now estimate that internet advertising grew 16% last year, up from our previous forecast of 12%.”

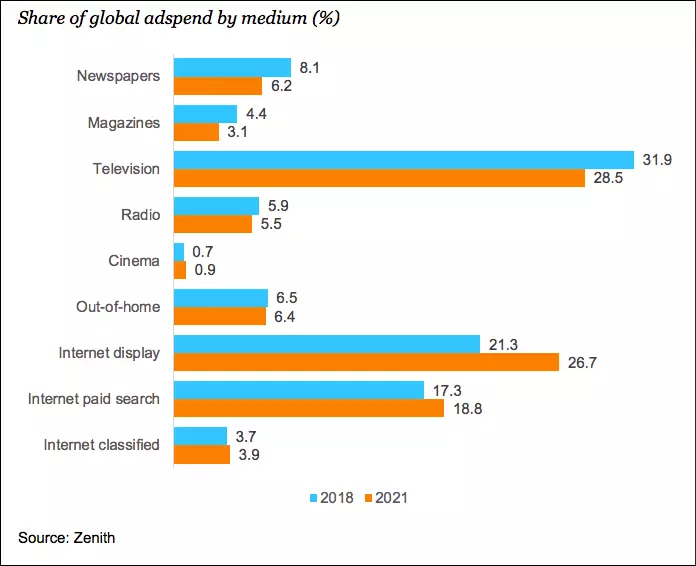

The report expects faster growth for the next few years with an average of 10% growth a year to 2021, up from our previous forecast of 9%. “We now expect internet advertising to reach USD 329-bn in 2021, and account for 49% of all global adspend, up from our 47% forecast in December,” the report said.

This growth is primarily being driven by overlapping channels of online video and social media, which is expected to grow by 19% and 14% a year to 2021 respectively. The forecast expects display advertising as a whole – which encompasses video and social, as well as banners – to grow by 13% a year, while paid search and classified lag behind, growing at an average of 7% a year each.

The biggest increases in internet forecasts is in the US, Russia and France with the report predicting increased our overall growth forecasts for 2019 from 2.9% to 5.0% in the US, from 7.1% to 8.2% in Russia, and from 3.7% to 4.7% in France.

The US accounts for 37% of all global adspend, so any upgrade here has a great effect on the global total. The US will by far be the largest contributor to global adspend growth between 2018 and 2021, adding USD 32-bn to the market.

The US accounts for 37% of all global adspend, so any upgrade here has a great effect on the global total. The US will by far be the largest contributor to global adspend growth between 2018 and 2021, adding USD 32-bn to the market.

China will be in second place, adding USD 16-bn, and India in third, adding USD 5-bn.

According to the report, OOH advertising is the fastest-growing ‘traditional’ medium in dollar terms. “We expect it to grow by USD 4.4-bn between 2018 and 2021, ahead of television’s USD 3.7-bn,” the report said. OOH is still benefiting from the spread of digital screens, but also from the emergence of programmatic trading, allowing agencies to make more efficient and effective data-enabled transactions.

Meanwhile, print advertising continues to decline. “We forecast magazine adspend to shrink by USD 5.0-bn between 2018 and 2021, and newspaper adspend to shrink by USD 6.3-bn, with no end to either decline in sight,” the report said.

Between 2013 and 2018, their combined share of global adspend fell from 24% to 13%, and we expect this share to fall further to 9% by 2021. Again, these figures only include advertising in printed publications – any advertising on publishers’ websites or other online brand extensions is included in the internet advertising total.

(Courtesy Agencies)

See All

See All