Media for the masses: Highlights from the M&E Industry Report

In March, KPMG India, in association with FICCI, released the Indian Media and Entertainment Industry Report, 2017. Titled ‘Media for the Masses: The Promise Unfolds’, the reports, in numbers and charts, highlights the growth trajectory of the different sectors — digital consumption, television, radio, sports, theme parks, print, films, animation VFX, live events — and other allied issues such as demonetisation, impact of goods and service tax, deal volume and values in 2016 and tax and regulato

19 Apr 2017 | By Dibyajyoti Sarma

In the foreword, Nitin Atroley, partner and head, sales and markets, KPMG in India; Uday Shankar, chairman, FICCI Media and Entertainment Committee and Ramesh Sippy, co-chairman, FICCI Media and Entertainment Committee, explain:

The year 2016 was a mixed bag for the Indian Media and Entertainment (M&E) industry. A slow economic recovery in the US and muted growth in China saw the global economy grow at a sluggish rate of 2.6%, with Brexit, the US election and the rise of protectionist and free trade rhetoric adding to business uncertainty. The Indian economy, nevertheless, is expected to outperform major economies with a projected Financial Year (FY) 2017 GDP growth rate of 7.1%, despite the speed bump caused by demonetisation.

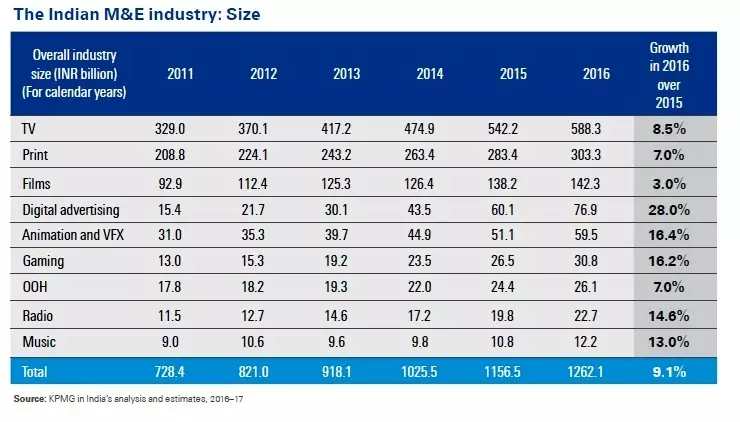

In 2016, the Indian M&E industry grew at 9.1% on the back of advertising growth of 11.2%. This was aided by strong fundamentals and a steady growth in consumption, although demonetisation shaved off 150 to 250 basis points in terms of growth.

Television experienced slower growth due to a lacklustre year for subscription revenues. Television advertising saw sunrise sectors such as eCommerce scaling back spend significantly and the event of demonetisation leading to an adverse impact across categories. However, strong long-term fundamentals driven by domestic consumption augur well for the future.

Films had a disappointing year with a near flat performance as the core revenue streams of domestic theatricals and cable and satellite rights declined, on the back of poor box office performance of Bollywood and Tamil films.

How print and advertising fared

Print revenue growth rates continued to register a slowdown, clocking a 7% growth in 2016 as English language newspapers continued to be under pressure. Regional language newspapers though continued to show strong growth. Additionally, the demonetisation move also adversely impacted advertisement growth in the last quarter of the year, particularly for regional language publications given their greater dependence on local advertisers.

Digital advertising continued its high growth trajectory with a 28% growth in 2016 to reach 15% share in the overall advertising revenues, though there was a marginal impact due to demonetisation. Advertisers’ interest has been captured by the continuing shift in consumption towards digital media on the back of rapid growth in internet penetration, mobile devices and falling data costs, with the launch of Reliance Jio providing an added impetus.

The OOH segment registered a slowdown in growth rate at 7% primarily due to the impact of demonetisation though long-term indicators remain positive, especially in the airport, transit and ambient segments. Although billboards continue to account for the largest revenue pie, new metro lines, malls, corporate parks and the leading airports are providing a much-needed boost to the overall sector.

Industry projections

The Indian M&E industry is projected to grow at a faster pace of 14% over the period 2016–21, with advertising revenue expected to increase at a CAGR of 15.3% during the same period. However, in 2017, advertising revenues are expected to grow at a marginally slower rate of 13.1% due to the lingering effects of demonetisation and initial volatilities arising from GST implementation.

Print is projected to continue its growth at 7.3%, largely on the back of continued readership growth in vernacular markets and advertisers’ confidence in the medium, especially in the tier II and tier-III cities. However, rising digital content consumption is perceived to be a long-term risk to the industry.

Digital advertising is expected to grow at a CAGR of 31% to reach Rs 294.5 billion by 2021, contributing 27.3% to the total advertising revenues by that point. As digital infrastructure continues to develop and data costs are driven down, digital consumption is likely to become more frequent and more mainstream.

The OOH is projected to grow at a CAGR of 11.8% primarily due to development of regional airports, privatisation of railway stations, growth in smart cities, setting up of business and industrial centres, and growing focus on digital OOH.

Radio is expected to grow the fastest amongst the traditional sectors at a CAGR of 16.1%, with operationalisation of new stations in both existing and new cities, introduction of new genres and radio transitioning into a reach medium.

The fallout of demonetisation

The government of India’s de-legalisation of high denomination currency notes led to a decline in consumption across sectors, such as FMCG, auto, banking, financial services and Insurance and real estate. This led to a pull back on discretionary spends on marketing and advertising, the repercussions of which were felt across M&E industry.

Advertising revenues across television, print and radio suffered while the attendance at cinema halls, particularly single screens, and live events, was also impacted. It is estimated that the annual advertising growth rates for television, print and radio were adversely impacted by about 1.5 to 2.5%.

However, the impact is expected to be shortlived, as since January 2017, there has been an upswing in consumption and advertising demand, although spend levels continue to remain lower than the same period in the previous year. It is expected that the spend level would be back to usual by Q2 2017.

GST to rationalise taxation

The GST, which is expected to be implemented in FY18, is likely to streamline the multiple incidences of taxes currently being levied by both the central and state governments. While the introduction of GST is likely to have varied levels of impact across the various media segments on an overall basis, M&E industry is expected to be a net beneficiary. This is primarily due to availability of input credits across the board and inclusion of entertainment tax within the ambit of GST.

However, GST rules are complex and particularly the move from a place of production-based taxation to destination-based taxation would require change in operating models to optimise the impact of GST. Further, adherence to compliance would also require multiple changes in an organisation’s IT and reporting systems.

It is expected that in 2017, there would be an initial adverse impact on advertising spend as organisations across the board struggle with the implementation of GST. However, in the long term, with the formalisation of the economy and widening of tax base, there could be a positive impact on the country’s GDP and consequently on advertising spends.

Consolidation gaining momentum

The M&E industry continued to witness consolidation in 2016 as leading players explored options to expand their footprint across genres and markets. Even though the number of transactions decreased in 2016, the overall value of deal increased compared to the previous year. While Dish TV and Videocon d2h merged operations to form the single-largest pay TV operator, Ten Sports was sold to Sony resulting in a two-player dominance in the sports genre. ZEE also acquired the TV broadcasting business of Reliance ADAG Group and acquired 49% stake in their radio business. The year 2016 also saw larger players in the radio segment expanding into non-metro cities and towns through acquisitions of smaller players in the industry.

The ‘Bharat’ story strengthens

Print has been a testament to the importance of small town and rural markets. Amidst the competition from digital media, the Indian print industry stands strong (unlike its western counterparts) on the back of growing demand from the regional markets.

In the film exhibition space too, the number of multiplexes witnessed an increase across smaller towns, with major operators entering tier-II cities leading to increased footfalls and revenue realisations.

Consumer analytics

Analytics is being extensively used across M&E now, as organisations look to evolve their business models and address various challenges emerging in competitive markets. Analytics provides customised solutions to assess the business impact and provide feedback on areas of improvement. The BARC viewership data is providing new insights to broadcasters and advertisers resulting in changes in content, distribution and advertising strategies.

On the cusp of transformation

While strong economic fundamentals would continue to drive growth, the Indian M&E industry is on the cusp of rapid transformation with digital media taking centre stage across all the sub-sectors. Digital media, which was earlier being viewed as just an additional distribution platform and just another touch point, is rapidly emerging as a core revenue engine.

While M&E organisations are looking to build out digital strategies, the economic and business models required to succeed in the digital landscape are challenging and would require a significant shift in mindset and approach.

See All

See All