Printed label demand to reach USD 48.16 billion

Printed label demand is set to grow to USD 48.16 billion in 2026 as market recovers from Covid-19 blip, according to the latest Smithers data forecast.

09 Oct 2021 | By Aultrin Vijay

Pressure sensitive labels, wider use of inkjet, and adoption of more sustainable print systems will be pivotal to future growth in sales of printed labels across 2021-2026. This market will reach a value of USD 41.75 billion with 1.21 trillion A4 equivalents printed in 2021, according to the new Smithers market report – The Future of Label Printing to 2026.

According to the report, the global market saw a small overall drop in 2020 as the global recession caused by the Covid-19 pandemic affected packaged goods sales. Label print volumes declined by -1.1% by volume and -0.8% by value in that year. This was moderate compared to many other print segments.

However, Smithers’ market analysis forecasts a quick return of lost sales, with a compound annual growth rate (CAGR) of 2.9% by value for 2021-2026. Label volumes will increase more quickly at a CAGR of 4% over the same period. The equivalent of 1.47 trillion A4 sheets will be printed in 2026, with a combined value of USD 48.16 billion.

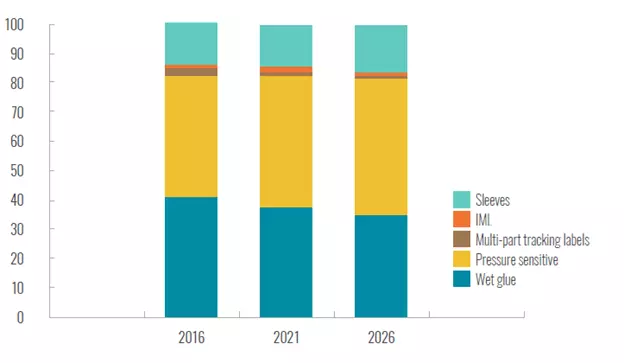

Smithers’ data set tracks print volumes and value for the five leading label formats – wet glue, pressure sensitive, multi-part tracking formats, stretch and shrink film sleeves and in-mould labels (IML). It shows the greatest rise in demand in 2021 will be for printing pressure sensitive labels, with sales value rising 6.1% in 2020. These formats – already 59.6% of the market – will account for the majority of value and volume growth over the next five years, although printed sleeves will also increase their market share.

According to the report, label print and narrow-web presses continue to be a focus for many print OEMs and have proven pivotal to the wider market penetration of digital (inkjet and toner) platforms. The majority of labels are still run on analogue presses, flexo accounts for 37% of output in 2021, offset litho represents 23.2%, and gravure adds another 13.8% – digital systems are only 9.0% of the market by volume.

By value the proposition for digital is more compelling, combined these represent 28.2% of the market, or USD 11.79 billion, in 2021. As this segment develops over 2021-2026, inkjet will become the preferred option with output growing at 13.1% year-on-year, while electrophotography falls back to a 5.3% CAGR.

“Beyond the adoption of digital print there are several compelling market trends that will be central to future success for narrow-web press manufacturers, ink suppliers, and print service providers,” the report stated.

“Improving the recyclability of labels and release liners is a major trend, supported by virtually all consumer brands and now enshrined in corporate sustainability targets. This will see more label collection schemes, easy-to-remove label formats, and the need to print on label stocks that are themselves constituted from recycled materials or biopolymer films,” the study found.

A similar impetus will call for more use of lighter weight labels, including much wider use of linerless labels, the report mentioned.

“Shrink sleeves continue to grow their share of the overall labels market driven by increasing appeal of full-colour, wraparound designs. By 2026 new materials will be introduced to replace some existing shrink sleeve substrates, encouraging easy separation,” it stated.

As demand for luxury goods returns, brands will look for more premium label options, including concepts for e-commerce and omni-channel sales, according to the study. This will provide a forum for the latest finishing and embellishment technologies: embossing/debossing, spot and high-build varnishes, lamination, hot and cold foiling, and special effect inks

The report also stated that online sales will also help make brand protection a more important consideration in label print. Brand owners are eager to switch to labels that carry unique identifier codes – to protect against counterfeiting, give more detailed marketing information, and enable better sorting and recovery at end-of-life – if the price is right

“Productivity improvements will be demanded via the greater automation of narrow-web processes. By the middle of the decade, there will be greater connectivity and integration with MIS systems, while converters will have unified print management platforms linking both analogue and digital print assets,” the report stated.

See All

See All