Smithers examines core factors for post-Covid packaging supply chains

The 2020 global pandemic will have a deep and enduring effect on packaging supply chains, according to a new dedicated study on the topic from Smithers. The disruption of 2020 has continued into 2021, with soaring prices for polymer resins other raw materials creating a new imperative for businesses to reappraise their supply chain, purchasing and logistics strategies.

09 Jul 2021 | By PrintWeek Team

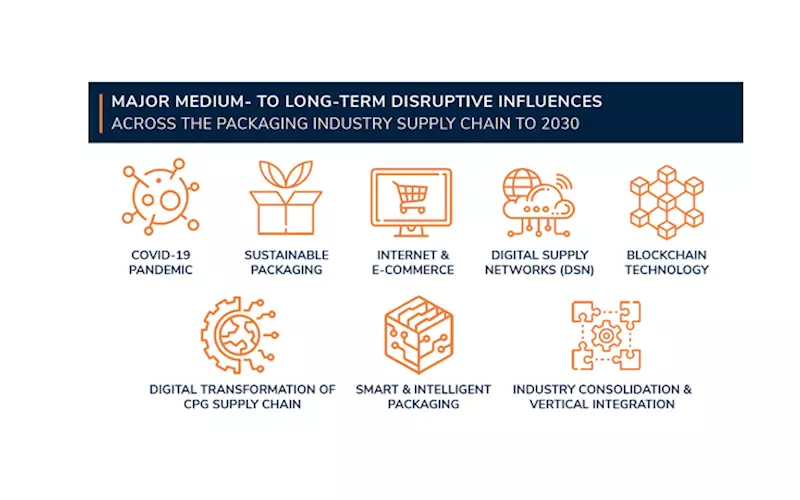

As resiliency has become the watchword for the future, Smithers brand new study – Impact of Supply Chain Disruption on the Packaging Industry to 2026 – charts how these networks will evolve over the next five years. Its expert analysis examines each phase of the supply chain for different packaging materials, and considers this within the context of changing consumer and brand owner perspectives for the future.

This leads it to identify five short-term challenges that will need to be negotiated as the packaging industry looks to move beyond COVID-19:

1 Overall, the world packaging demand fell across 2019-2020, but sales of food, medical devices and pharmaceuticals held up well. Other industries, like personal care and consumer goods, saw a much sharper fall off in demand. Suppliers need to prioritise and protect these essential channels, while being flexible enough to aid those worse effected segments to rebound quickly in 2021

2 Closure of raw material supplier facilities in 2020, has led to a shortage of some materials into 2021, and necessary maintenance work postponed during Covid has had to be rescheduled for H1 2021

3 For plastics, resin prices have risen to record levels, as the post-Covid surge in demand has combined with increased shipping costs, and temporary weather-related shutdowns of US crackers in February-March. This has led in the short term to force majeure announcements. Stability will return in the medium term; but cheaper imports will continue to pressurise EU polyolefin manufacturing

4 The re-emergence of sustainability concerns in packaging, including new legislative targets for minimum recycled content in plastic formats. This is prioritising the sourcing and processing of post-consumer recycled (PCR) resins, in place of virgin feedstocks

5 Increased consumer use of eCommerce channels in 2020 and beyond is a positive for the industry, and corrugated board companies in particular; but eCommerce sales also call for compact, sustainable designs and alternative materials.

Once stability returns there will be direct changes in supply chains for packaging in the medium term; among the most important identified by Smithers’ survey are:

1 Reshoring supply of raw materials and greater inventory to protect against future demand shocks

2 An emphasis on sourcing sustainable materials, with a higher priority given to recycled and recyclable packaging generally, and post-consumer recycled PET and other plastics in particular

3 For larger packaging companies, there will be an impetus towards more vertical integration to give them better oversight of supply chains and greater control over material supply to enable them to achieve future sustainability targets

4 The need for packaging to complement the post-Covid trend for CPG brands to emphasise a more personalised user experience, in online and conventional sales

The challenges and market opportunities for these and other shifts in the supply and demand for packaging over the next five years are profiled, in depth, in Impact of Supply Chain Disruption on the Packaging Industry to 2026.

See All

See All