Global PET packaging demand to reach USD 44.1 bn this year

A Smithers report has identified that the market for polyethylene terephthalate (PET) packaging will grow despite the pressure over its environmental impact.

24 Oct 2020 | By Aultrin Vijay

According to a recent study by Smithers, bottles and other rigid plastic packaging made from polyethylene terephthalate (PET) are growing in demand despite pressure over their environmental impact. While Covid-19 is the immediate challenge, new recycling technologies and alternative feedstocks will be increasingly important over the five years to 2025, the study revealed.

Data from the Smithers market report titled The Future of PET Packaging to 2025 shows global demand will reach 22.65 million tonnes, with a value of USD 44.1 billion in 2020. “The impact of Covid-19 is still unclear, and while volume consumption will increase this year, the overall value could shrink by as much as 17% compared to 2019. As it recovers, future growth in this segment is forecast at a compound annual growth rate (CAGR) of 3.7% pushing consumption to 27.13 million tonnes in 2025,” it stated.

The Smithers expert analysis subdivides the market across all key industry segments including end-use applications, geographic markets and company profiles for over 20 leading PET packaging producers worldwide.

While a few of the major companies dominate the global PET packaging market it does remain somewhat fragmented, despite the industry consolidation that has happened in recent years, the study found. Several major PET packaging producers are now acquiring PET recycling capabilities and growing their use of post-consumer PET packaging material to meet sustainability goals. Brand owners are increasingly taking bottle-blowing in-house, rather than buying from specialist bottle producers.

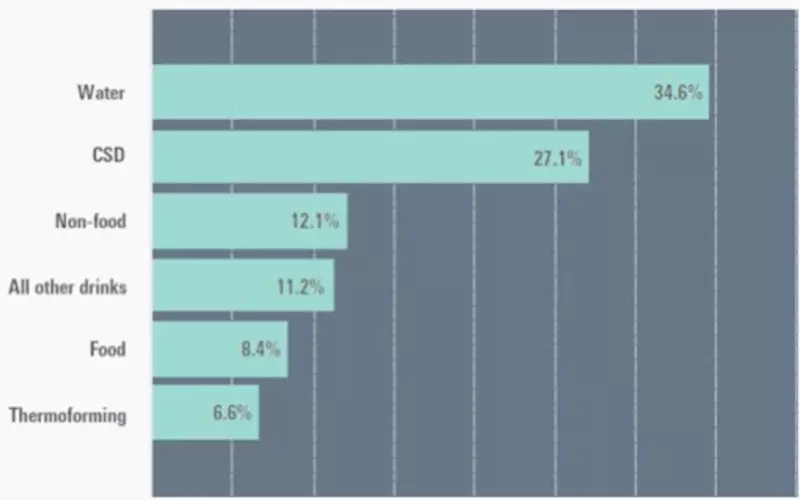

According to the study, bottled water and carbonated soft drinks (CSDs) are the dominant markets for PET packaging. In 2019, bottled water was the largest end-use market, accounting for 34.6% of global PET packaging consumption, with CSDs representing 27.1%.

“Bottled water is forecast to display continued strong growth for PET packaging. Demand for CSDs will be slower, due largely to European and North American consumers switching to healthier drinks. Other growing sectors include sports and energy drinks and ready-to-drink teas. For jars, technological advances in barrier solutions and hot-fill are allowing PET to be used for more sensitive products, such as juices, jams, and other preserved foods,” the study found.

Asia-Pacific is has been identified as the largest regional PET packaging consumer, accounting for 36.7% of global PET packaging consumption in 2019. North America is the second-largest regional market with a share of 20.5%, followed by Western Europe with 17.9%. For 2020-2025, PET packaging consumption in Asia-Pacific is forecast to grow at the fastest rate, along with the Middle East and Africa. Rising standards of living, growing urbanisation, a developing retail infrastructure, and the replacement of traditional pack types are said to drive this.

It also identified that consumer advocacy has been pushing brand owners and national governments to restrict plastic in packaging. “This negative sentiment is seeing retailers and brand owners look for polymer packaging that is recyclable and can incorporate higher levels of recycled content. While recycled PET demand is growing, collection rates for post-consumer PET bottles will have to grow faster to meet European Union targets for recycled content in packaging,” the study noted.

Simultaneously, resin producers are said to be evolving improved formulations of PET for packaging. Bio-based plastics, including 100% bio-based PET bottles, are set to gain market share over the forecast period, the report mentioned.

“More recent developments to commercialise chemical recycling of mixed plastics waste have the potential to be a game-changing innovation for sustainable PET feedstock supply,” it stated.

See All

See All